Sustainable metals for electromobility

The role of sustainable metals for electromobility

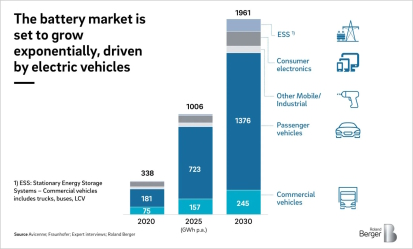

Many governments set goals for developing markets for electromobility.

To achieve such goals, we need metals - and despite all the efficiency successes, not less, but more metals are needed than before.

Today, an average car already contains around 150 kilograms of aluminum, 25 kg of copper, 10 kg of zinc and many other metals in addition to steel.

An electric vehicle also requires metals for the electric motor and the energy storage system - such as a lithium-ion battery. The electric motor alone, for example, increases the amount of copper in

the vehicle from 25 to 65 kilograms. A 20 KWh lithium-ion battery requires another 100 kg of aluminum, 80 kg of copper, 60 kg of steel and 20 kg of nickel - as well as lithium, cobalt and other rare

metals - according to the current state of the art. These are just average numbers, yet, per vehicle!

This simple analysis clearly reveals that without metals - and above all without innovative metal recycling at highest environmental and safety standards - sustainable, resource-conserving

development of the emerging market for electromobility is not possible.

This is even more essential when considering that the production of an electric vehicle requires more valuable primary (mineral) or secondary (recycled) resources and also causes higher emissions

than is the case with a traditional combustion vehicle.

The role of special and rare metals for electromobility

Special raw materials such as lithium, rare earth metals or cobalt are used in many components of the powertrain, which raises the question of how sustainable the use of electrically powered vehicles actually is and which kind of measures and research tasks exist to provide these metallic materials in a sustainable way, establishing a circular economy for such vehicles, not through cheap marketing slogans but in the real world and through real metallurgy, physics and chemistry. Metals in this group are - besides lithium - copper, cobalt and rare earth metals.

Example: Sustainable Copper for Electromobility

Why is Copper essential for electromobility?

Copper is on the most essential elements for electromobility and generally for the electrification of households, industry and transportation.

It is required for green energy production, an efficient energy network, electrification, automation and digitalization and - above all - mobility.

On average, an electric vehicle contains almost three times as much copper as a vehicle with a conventional combustion engine. Half of this copper is in the accumulator. There is also a high demand

for copper in the generation of electricity from renewable energies and the infrastructure needed to charge electric vehicles.

Why is Copper needed for batteries and other vehicle parts?

The lithium-ion battery alone consists of around 18% copper, since the cathode is always made of aluminum and the anode of copper as a carrier material. At least one drive motor and one converter contribute to the fact that there is easily three times as much copper in such a vehicle as in a conventional vehicle with an internal combustion engine - namely around 25 kg in the average gasoline-powered mid-size vehicle. In the future, the weight of copper is expected to rise to as much as 40 kg, as the desire for greater comfort means that many small electric motors containing copper will be needed. The largest increase in copper weight is expected in the area of new components added to electrified vehicles - drive energy storage, electric motor, high-voltage vehicle electrical system, power electronics, etc. In the case of a plug-in hybrid, this can be more than 70 kg of copper in the mid-range, while the electrical car is just below that.

How much Copper is needed for electro-mobility?

The massive introduction of electric traction motors in vehicles will lead to a significant increase in copper demand over the next decade. A recent study, commissioned by the International Copper Association (ICA), shows that by 2030 more than 250,000 tons of copper per year will be used as part of the windings in electric traction motors in on-road electric vehicles. The increase in copper demand follows the development of the global automotive market, where pure battery electric cars are expected to gain the most market share at the expense of internal combustion engines and hybrid vehicles. By 2030, electric and plug-in hybrid cars will account for about 19 percent of the total market, rising to 72 percent by 2040 in a declining automotive market that is expected to peak in 2031.

Recycling of Copper

Recycling conserves resources, reduces environmental impact, and saves energy by eliminating the energy

required for the mining, processing, and smelting steps. Copper is one of the most recycled materials in the world, besides Steel and Aluminium. The collection and trade of scrap and used

materials for copper and copper alloys has been well organized. The reason is the excellent suitability of copper materials for reuse.

About 44% of EU copper demand is matched by recycled copper scrap; about 70% of the copper contained in End-of-Life products is coming from recycled scrap copper. About 90% of the copper used in

civil infrastructures comes from secondary material.

The low natural copper supply in the EU (48 million tons) leads to a high dependence on recycling, otherwise imports of primary but also secondary copper would have to increase to meet domestic

demand.

Despite the copper scrap used in the domestic production process, additional copper waste and scrap is imported, making the EU a net exporter of copper scrap.

In addition to energy savings, the decisive factor in evaluating the production of metals from return materials and scrap is the quality that can be achieved during recycling. If this is not

achieved, then the benefits in terms of energy savings are questionable as the energy requirements of dissimilar materials are compared. For example, unlike copper, with some other metals and with

plastics it is not readily possible to produce products of the same quality as those made from virgin metals. With copper, on the other hand, it is possible to produce products that do not differ in

any way from those made from primary metals without any loss of quality. The decisive advantage in the recycling of copper materials lies precisely in the fact that copper does not suffer any loss of

quality even if it is recycled several times, irrespective of whether metallic or non-metallic, low-copper or high-copper input materials are sent for reuse.

The recycling rate is usually estimated from the quantity produced per year from secondary materials in

relation to the total annual production. For copper, this definition results in a recycling rate of approx. 50 %. However, this figure says little about the reuse of a material. This is because the

definition does not take into account the fact that end-of-life material comes from durable assets that were manufactured at a time when annual copper production was significantly lower. And when

calculating the recycling rate, secondary copper production is based on today's much higher production. This classic recycling rate is misleading in that it does not express the true degree to which

end-of-life copper materials are reused.

Another measure for the recycling rate for copper is obtained by referring it on the useful life of the products until reuse and relating the amount of copper reused to the total production at

the beginning of the useful life. Copper and copper alloys have a long useful life because of their excellent durability.

Motivation for recycling Nickel for Battery Electrodes

In recent decades, the increasing demand for energy storage solutions has driven the rapid development of battery technology. Lithium-ion batteries, in particular, have emerged as a dominant player in portable electronics, electric vehicles, and grid-level energy storage systems. As the world shifts towards sustainable energy practices, the importance of recycling materials used in these batteries, such as nickel, cannot be overstated. Therefore, this webpage reflects some of the intricacies associated with recycling of nickel for use in battery electrodes, highlighting the challenges, processes, and environmental implications.

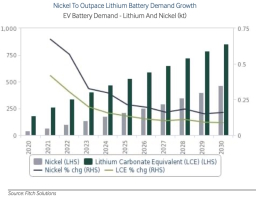

It is expected that the nickel demand for EV battery manufacturing will experience an annual average growth rate of 30% over 2021-2030, thus outpacing demand for both lithium and cobalt. This estimate is a significant increase from eaelier market analysis forecast, due to upwards revisions in its EV sales forecasts.

Nickel demand is fostered by the metal's persisting role in battery cathode chemistry, with downside risks caused by concerns over future supply availability. Current forecasts are made under the underlying assumption that NMC (Ni Mn Co) 811 cathodes will rise to 80.0% of the total NMC market share by 2027, whcih amounts to effectively raising the overall average nickel content of a cathode in EVs.

Also, it is assumed that nickel-dominant cathodes wil be favored particularly for heavy-duty and long-range vehicles and shortages of Class 1, battery-grade nickel may encourage automakers to explore lithium-iron-phosphate (LFP) batteries for mass market vehicles, however.

EV automakers noted that nickel supply remains the biggest obstacle to scaling lithium-ion cell production.

Particularly thius fast growth of the electric vehicle market and the expanding use of renewable energy storage systems have led to an increased demand for battery materials, including nickel. As

primary nickel reserves are finite, recycling has become a vital strategy to ensure a sustainable supply chain and minimize environmental impact. Recycling nickel from spent batteries offers several

advantages:

1. Resource Conservation: Recycling reduces the need for extracting and refining new nickel ores, preserving valuable natural resources and decreasing the environmental impact of mining

activities.

2. Energy and CO2 Savings: The highly CO2- and energy-intensive process of mining, refining, extracting and processing nickel ores can be avoided through recycling, leading to significant energy

savings and reduced greenhouse gas emissions.

3. Waste Reduction: Battery waste contains valuable metals like nickel, cobalt, and lithium. Recycling these materials not only prevents their disposal in landfills but also recovers valuable

resources for future battery production.

The Role of Nickel in Battery Electrodes

Nickel is a crucial element in the cathodes of lithium-ion batteries. Its unique properties, including high energy density, good cycling stability, and relatively low cost, make it an ideal choice for electrode materials. Nickel is often used in combination with other elements such as cobalt and manganese to create various cathode formulations, each offering a distinct balance between energy density, stability, and cost.

What are the main challenges in Nickel recycling?

Recycling nickel from battery electrodes presents certain challenges due to the complex composition and structure of lithium-ion batteries. These challenges include:

1. Battery Design Diversity: Batteries come in various shapes, sizes, and chemistries, making the development of a standardized recycling process challenging.

2. Material Separation: Efficiently recovering nickel requires separating it from other materials, such as lithium, cobalt, and manganese, which often involves complex hydrometallurgical or

pyrometallurgical techniques.

3. Chemical Contaminants: Impurities and contaminants can accumulate during battery use, affecting the quality of recycled materials. Proper purification steps are necessary to ensure the recovered

nickel meets the required specifications.

4. Economic Viability: The economics of recycling depend on factors such as the market price of recovered materials, recycling efficiency, and initial investment costs.

Some Recycling Processes for Nickel Recovery from EV Battery Scrap

The recycling of nickel from battery electrodes involves a multi-step process:

1. Collection and Sorting: Used batteries are collected and sorted based on chemistry, size, and state of charge.

2. Dismantling: Batteries are disassembled, and electrode materials are separated from other components, such as separators and electrolytes.

3. Material Recovery: Recovering nickel involves either pyrometallurgical processes (smelting) or hydrometallurgical processes (leaching). Pyrometallurgical methods involve high-temperature treatment

to separate metals, while hydrometallurgical methods use chemical processes to dissolve and separate metals.

4. Purification: The recovered nickel undergoes purification to remove impurities and contaminants.

5. Formulation: Purified nickel can be combined with other materials to create new cathode formulations suitable for battery production.

6. Battery Manufacturing: The recycled nickel is integrated into new battery electrodes, closing the recycling loop.

Hydrometallurgical processes for nickel recovery

Hydrometallurgical processes for nickel recovery involve the dissolution of nickel compounds from spent

battery electrodes using chemical solutions. The primary steps of the hydrometallurgical nickel recovery process are as follows:

1. Dismantling and Preparation:

Spent battery electrodes are dismantled, and the electrode materials are separated from other components. This step requires careful handling to prevent cross-contamination and ensure the quality of

recovered materials.

2. Leaching:

Leaching is the core step where nickel is extracted from the electrode materials. Common leaching agents include sulfuric acid (H2SO4) or hydrochloric acid (HCl), depending on the specific battery

chemistry. Leaching agents react with the electrode materials to dissolve nickel and other metals into solution.

3. Solid-Liquid Separation:

After leaching, the resulting slurry is subjected to solid-liquid separation to isolate the dissolved nickel solution from the remaining solid residues. Techniques such as filtration or

centrifugation are used to achieve this separation.

4. Purification:

The leach solution typically contains various metals, including nickel, cobalt, and manganese. Selective purification steps, such as solvent extraction or ion exchange, are employed to separate

nickel from other metals. These methods exploit the differing chemical properties of metals to selectively remove impurities.

5. Precipitation and Recovery:

Once purified, the nickel is selectively precipitated from solution using techniques like solvent extraction or chemical precipitation. The recovered nickel can be further processed to achieve the

desired level of purity for subsequent battery electrode manufacturing.

Challenges in Hydrometallurgical Nickel Recovery

Recovering nickel through hydrometallurgical processes is not without its challenges, and experts often encounter the following intricacies:

1. Selective Leaching:

Achieving selective leaching of nickel while minimizing the dissolution of other metals is a critical challenge. Adjusting leaching parameters such as temperature, acid concentration, and agitation

rate requires careful optimization to maximize nickel recovery.

2. Contaminant Control:

Contaminants present in the electrode materials, such as binders and electrolyte residues, can interfere with leaching and downstream processes. Developing effective pre-treatment methods to remove

or mitigate these contaminants without causing additional environmental or operational issues is essential.

3. Impurity Management:

The purification step is crucial for obtaining high-purity nickel. Managing co-recovery of impurities during the purification process requires precise control of conditions and selection of

appropriate purification agents.

4. Solution Recycling and Effluent Treatment:

Hydrometallurgical processes generate waste solutions containing acids, metals, and other chemical compounds. Efficiently recycling or treating these solutions to minimize environmental impact while

recovering valuable materials poses a complex challenge.

5. Energy Consumption:

Hydrometallurgical processes can be energy-intensive, particularly during leaching and solution purification. Reducing energy consumption while maintaining process efficiency is a key

consideration for sustainable nickel recovery.

6. Innovation and Future Prospects

Advancements in hydrometallurgical technologies, such as the development of novel leaching agents, innovative separation techniques, and enhanced purification methods, hold promise for overcoming

these challenges. By continuously refining the hydrometallurgical nickel recovery process, experts can contribute to more efficient and environmentally friendly recycling practices, ensuring a

sustainable supply of nickel for battery electrodes.